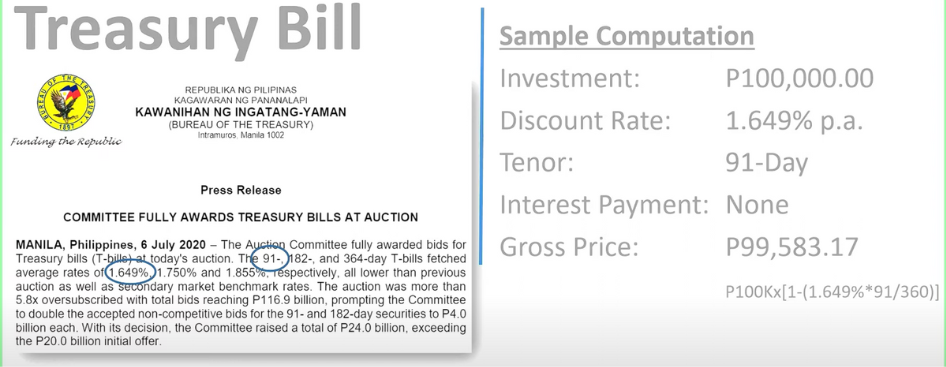

Bonds

Bonds are a type of debt instrument. It is a method through which governments or companies raise funds. Institutions issue bonds and promise to pay regular interest payments to the investor. The main difference is that a bond is highly tradeable. Bonds also have credit ratings.